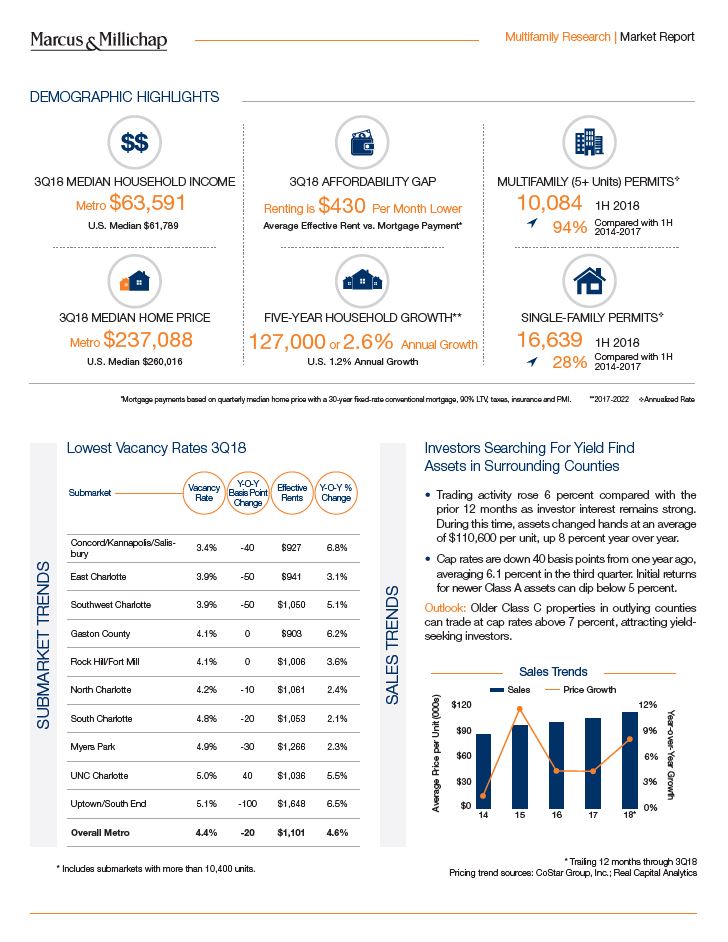

Marcus & Millichap released their 2018Q4 multifamily market report for Charlotte. The study finds that metro vacancy rates have declined 20 basis points to 4.4 percent over the past year while average rents have increased 4.6 percent. The researchers attribute this to the strong household formation (2.6 percent annualized) and economic growth (2.5 percent annualized) taking place in the greater Charlotte area.

According to the report, 7,800 apartment units were completed over the past 12 months, a 200-unit increase over last year. Although multifamily production is up, units are being absorbed quickly. According to the report: “Even though construction is brisk, robust renter demand lowered vacancy to 4.4 percent in September.”

The report also finds a $430 monthly affordability gap for renters versus owners and significant demand for older apartment units. According to the report: “Older, more affordable buildings registered the strongest year-over-year rent increase. In pre-1970s apartments the effective rent vaulted 5.2 percent to an average of $873 per month.”

This underscores the need for more workforce housing in the greater Charlotte area.

The following link will take you to the report: